Income Tax Return Filing

What Is Income Tax Return Filing ?

Income Tax Return filing is the process of providing a declaration about the Income and Expenditure of the taxpayer to the Income Tax Department. This declaration is used to determine the tax liability of the taxpayer.

The tax liability is decided based on the current tax rate slab. The income tax department prescribes this tax slab.

ITR Filing is mandatory for Taxpayers whose income exceeds the prescribed income limit. This process is regulated under the Income Tax Act 1961.

The declaration contains details about the income earned during the period of 1st April to 31st March.

(If you want to know the income tax payable by you, then you can use this calculator - Income Tax Calculator)

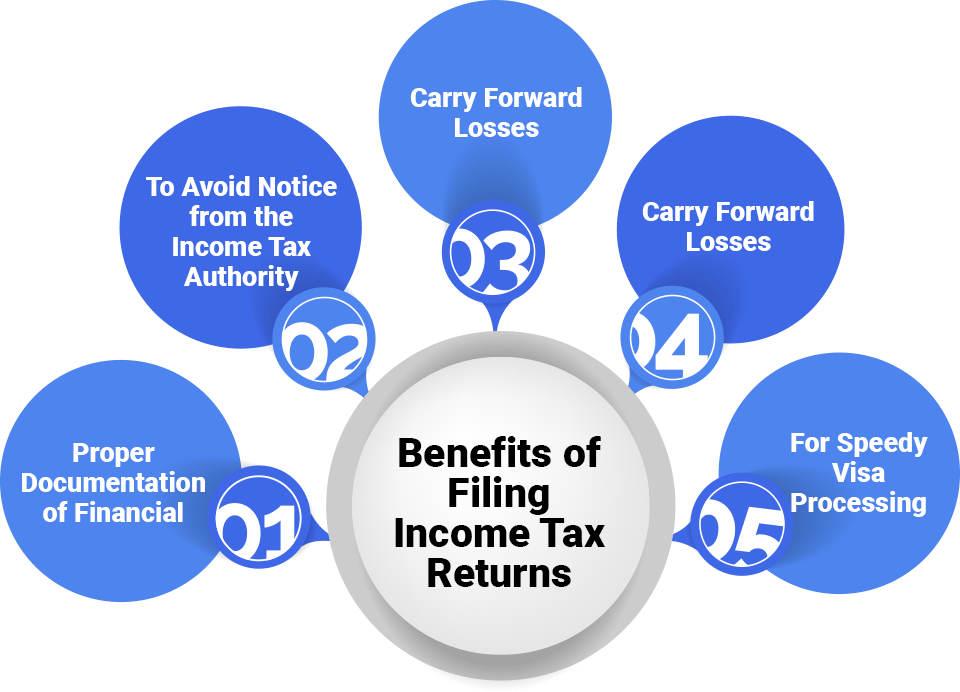

Benefits of Filing Income Tax Returns

Avoiding Notices and Penalties

Proper documentation ensures accuracy in your income tax return, reducing the likelihood of discrepancies that could trigger notices or audits from tax authorities. It helps you maintain compliance and avoid penalties for errors or omissions.

Efficient Carry Forward of Losses

Accurate and detailed records allow you to properly carry forward losses to future years, as permitted by tax laws. This can help offset taxable income in future years, reducing your overall tax liability.

Clear Proof of Income and Expenses

Well-organized financial documentation provides clear evidence of your income and expenses. This is essential for verifying claims, deductions, and exemptions, and can help resolve any queries or disputes with tax authorities.

Streamlined Tax Filing

With proper documentation, preparing and filing your tax return becomes more efficient. Accurate records make it easier to compile necessary information and complete your return, reducing the risk of errors and omissions.

Enhanced Financial Planning

Maintaining detailed financial records supports effective financial planning and decision-making. It provides insights into your financial health, aids in budgeting, and helps you make informed decisions about investments and expenses.