Income Tax Notice

Income Tax Notice

When a tax payer files the income tax return to the department, then after the submission of the return, then the department process the return and at that time department may issues various type of notice to the tax payer, which may be sometimes in the form of Intimation or may be some time in the form of scrutiny.

Tax-Payer may always get worried of Income tax notice when they heard of it, but there is nothing to be worry about it. There is always a reason for the notices.

We need to understand the notice issued by Income tax department.

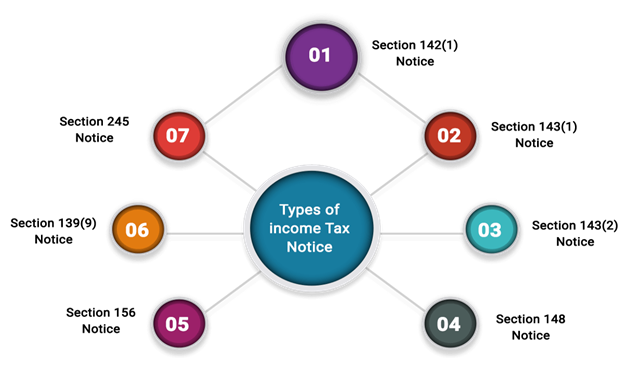

Types of Income Tax Notice

Notice Under Section 143(1)

This is an intimation notice, often issued after the assessment of your income tax return. It informs you of any discrepancies, adjustments, or refunds.

Notice Under Section 143(2)

This notice is issued if the tax authorities want to conduct a detailed scrutiny of your tax return. It typically follows the initial notice and is part of the process for a detailed assessment.

Notice Under Section 142(1)

This is issued to call for additional information or documents from you to complete the assessment. It may also require you to attend an assessment proceeding.

Notice Under Section 139(9)

This is a notice of defective return, indicating that there are errors or omissions in the return filed.

Notice Under Section 148

This notice is issued if the tax authorities believe that income has been omitted or has not been reported. It initiates the process of reassessment of the tax return.

Notice Under Section 156

This notice is issued when there is an outstanding demand, and it informs you about the amount you owe and the deadline for payment.

Notice Under Section 271(1)(c)

This notice is issued if the tax authorities believe that you have concealed income or provided inaccurate details in your tax return, leading to potential penalties.

Notice Under Section 275

This notice is issued to inform you about the order of penalty and the time limit within which it must be paid.