GST Return Filing

Introduction to GST Return Filing

GST Return Filing is a mandatory compliance for every business that is registered under the GST Act/regime.

Under GST (Goods and Services tax), filing the GST returns is a crucial activity that works as a link between the government and the taxpayer.

While filing the return, the taxpayer has to provide the information such as the details of the business activity, payment of taxes, declaration of tax liability, and other information as required by the government.

GST returns are supposed to be filed electronically, i.e. on the GST portal. However, there’s a facility where one can also file GST returns manually.

Who all are required to file GST Returns?

Every GST registration holder who is taxable under the GST Act, 2017 are required to file GST returns as based on the nature of their business.

Therefore, whether you are engaged in the selling of goods or render services to others, you must obtain GST registration and file the returns periodically.

Under GST, a registered dealer involved in the following activities needs to file GST return:

Sales

Output GST (on Sales)

ITC (Input Tax Credit) with GST paid on purchase .

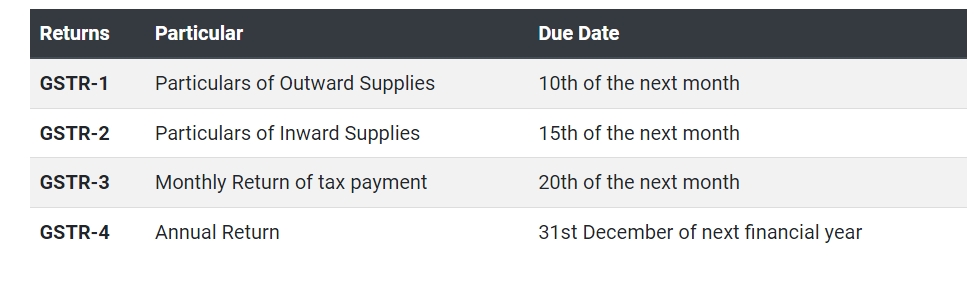

Returns to be filed by a Normal Taxpayer

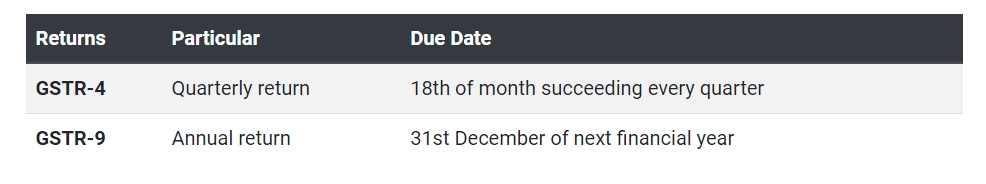

Returns to be filed by a Composition Taxpayer

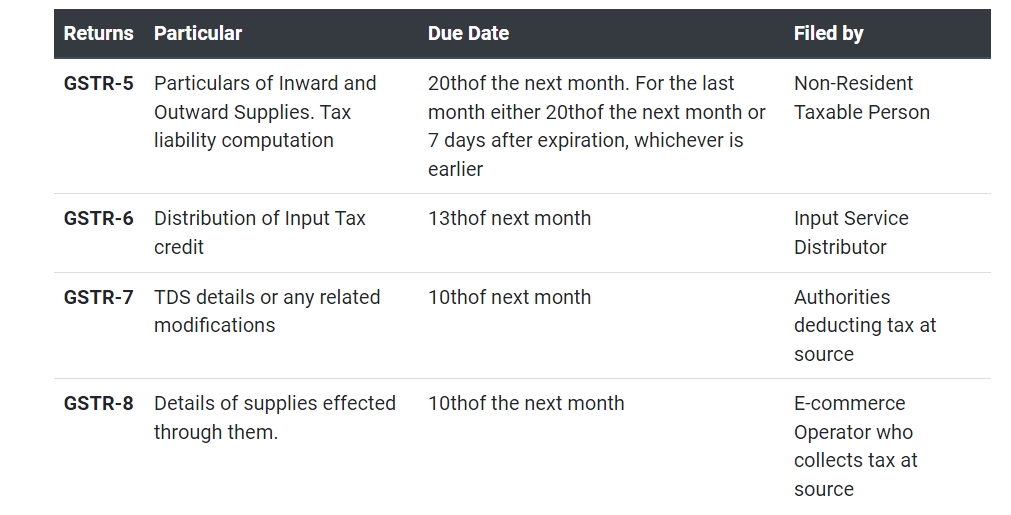

Additional Returns based on the Nature of the Business

The above-stated returns are made compulsory by the Central Goods and Services Act (CGST) Act, 2017. However, the GST is altogether a new concept; therefore, it’s not that easy for the taxpayers to adjust the right way.

Hence, with a motto to make this transition to the new tax regime easy some relaxations have been introduced by the authorities.