PF Return

What Is PF Return?

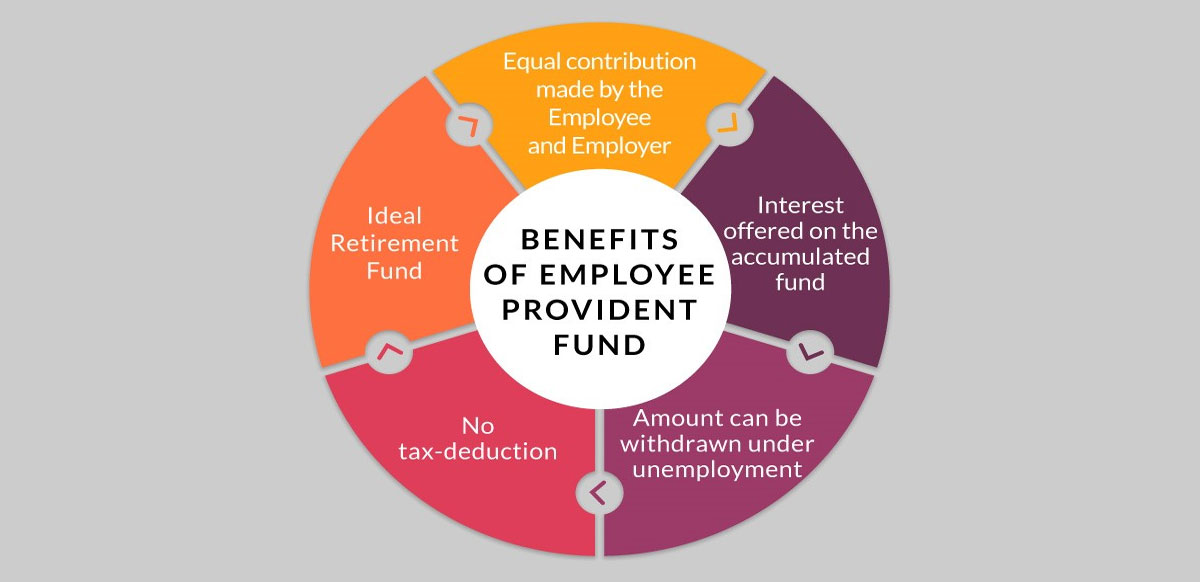

Employees Provident Fund is a retirement benefit scheme for all salaried people and this fund is maintained by Employees Provident Fund Organization of India (EPFO) and any company having 20 employees or more is required to register with EPFO.

During the working tenure, employee and employer both contribute 12 percent of the basic salary of employee into EPF account. Employee's entire 12 percent goes into EPF account and Employer's 3.67 percent is transferred into EPF account of employee. Rest 8.33 percent from employer's side is diverted in Employees Pension Fund (EPF).

Benefits of PF Return Filing (Provident Fund) Return

There are different forms of benefits which can received from filing the PF return. The following are the benefits of filing the PF return:

Welfare of the Employees

The employees will understand that the organisation values the welfare of the employees. This will increase the amount of employee welfare.

Compliance with Law

Any company complying with the requirements of EPF will be benefitting from the scheme. Apart from this, the company would also remain transparent throughout the whole process of provident fund registration.

More Social Security

Apart from having a secure system of social security, the whole process related to PF is managed by the Employee Provident Fund Organisation (EPFO). Such organisation regulates the entire process of PF registration. Hence complying with such systems makes the entire process hassle free.

Benefits of Insurance

Any organisation which does not have some form of insurance would get the benefits of the Employee Deposit Linked Insurance Scheme (EDLI). Through this scheme employees can secure the benefits of insurance. For this 5% of the monthly contribution must be paid as a premium for this form of insurance to be applicable.

Medical Benefits

An employee can withdraw specific amount of salary from this contribution which is equivalent to six times or the entire amount whichever is lesser for medical expenses during emergencies.